What Business Owners Need to Know About GST

Expecting more that $30,000 in annual revenue from your business? Then you must obtain a GST number from the Canada Revenue Agency (CRA). It’s easily obtained with a call (including their hold time!) to the CRA.

Do You Need a GST Number?

If you started business without a GST number and expect to surpass the $30,000/year threshold, then you (or us, if you’d like) must call the CRA and get one. They will give you the effective date (usually the day called). From that date onward the rules below will apply.

How is the GST Number Used?

You must netfile GST after each ‘reporting period.’ New companies usually have an annual reporting period. As you grow this might be increased to quarterly and even monthly filings. The end of the reporting period, or one of them, should be the same date as your fiscal year end (always Dec. 31 for a sole proprietorship).

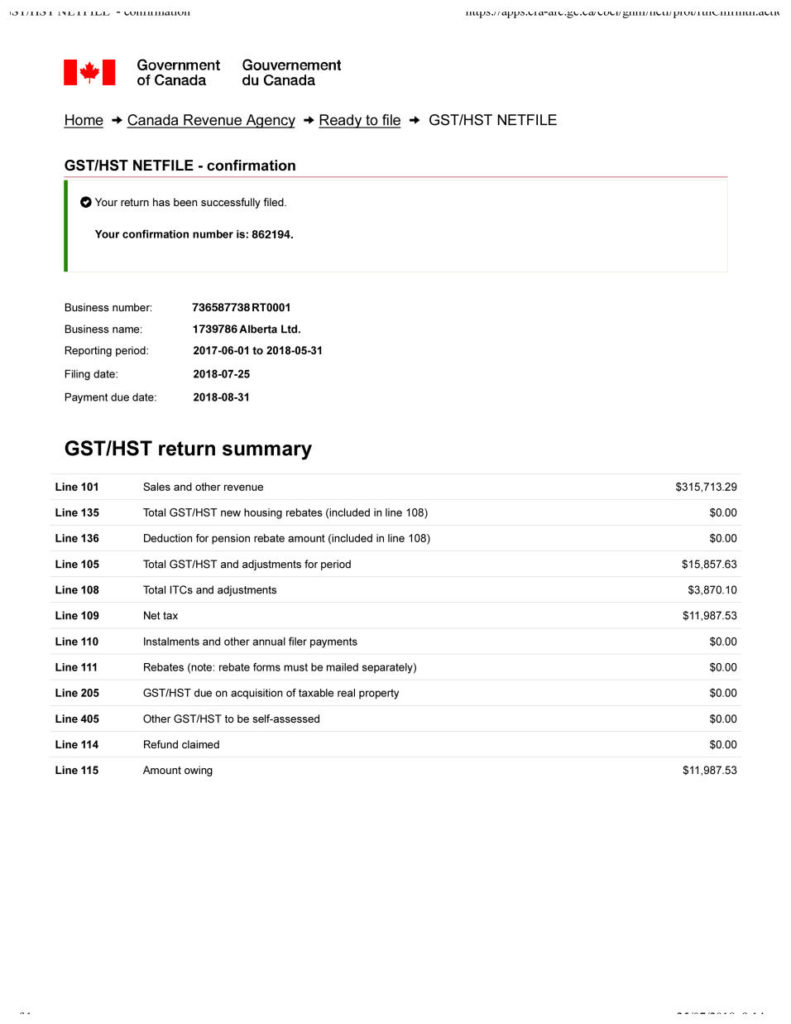

Typically, we will do the netfiling and send you a copy of the CRA’s confirmation. This lets you know how much to send the CRA, or you’ll get as a refund.

What is a GST Account Number?

Get confused about the different CRA accounts and how they are numbered? Here are the basics:

- Your company’s business number (B/N) is 9 digits (e.g. 123456789)

- Your company’s GST number is the B/N with an RT 0001 suffix (e.g. 123456789 RT 0001)

- You MUST show your GST account number on your invoices and/or receipts

- The suffix usually ends with the ‘1’; rarely it’s another numeral

What is/are My Reporting Periods?

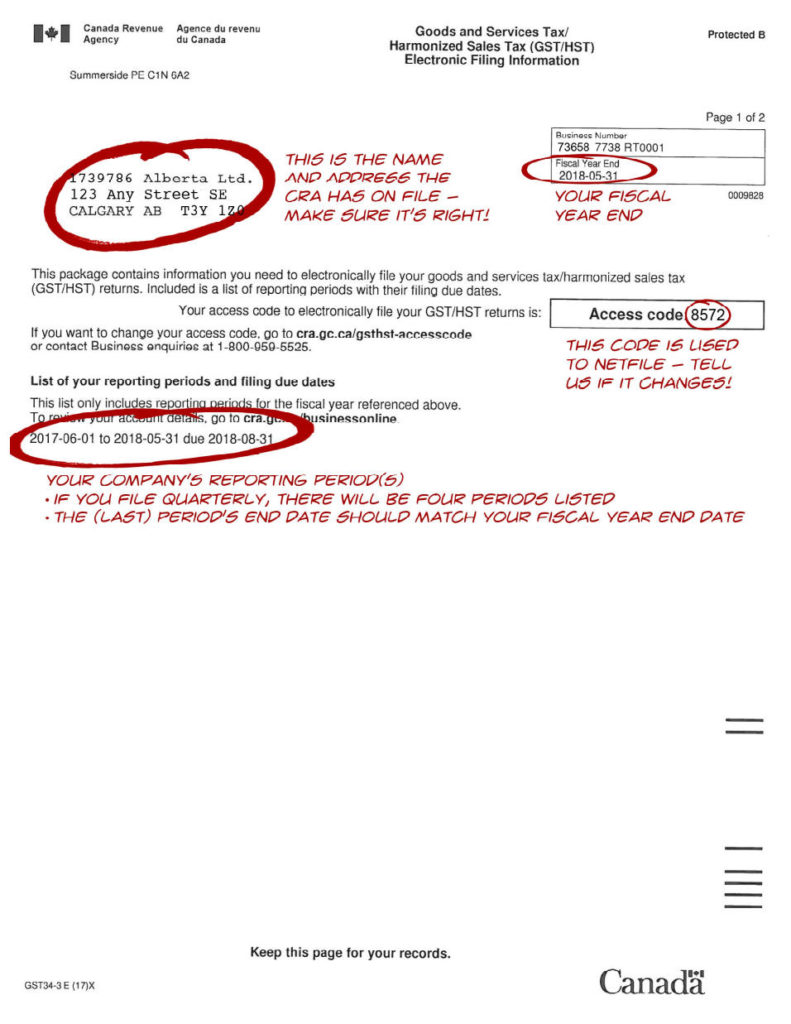

After getting a GST number the CRA will (snail) mail you a “Goods and Services Tax/Harmonized Sales Tax (GST/HST) Electronic Filing Information” letter. Please provide us a copy ASAP. An updated version will also be mailed to you at the end of each year end (fiscal for a corporation, calendar year for sole proprietorship).

Here is a sample of what an “Electronic Filing Information” letter looks like:

After we netfile your GST online, here’s what a confirmation looks like:

How is GST Remittance Calculated?

There are variations, and so we’ll only look at the two most common situations. The basic rule is that the amount due or refunded is the difference between the amount collected and amount paid out, whichever is larger. Here are two illustrative examples.

Example 1: You must send money to the CRA

Your sales during the reporting period are $20,000. At 5% you collected $1,000.00 in GST. During that period you bought $12,500 worth of goods subject to GST, and so paid $625.00.

The difference ($1,000.00 less $625.00) is $375.00, which must be sent to the CRA.

Example 2: You get a refund from the CRA

Your sales during the reporting period are $20,000. But only half these sales are subject to GST (e.g. bakery, grocery store). At 5% you collected $500.00 in GST. During that period you bought $12,500 worth of goods subject to GST, and so paid $625.00.

The difference ($625.00 less $500.00) is $125.00, which will be refunded by the CRA.

You Can Make Installment Payments

You are permitted to make GST payments during a reporting period. For example, your reporting period is annual and you usually remit around $4,000 per year. You can choose to make random quarterly payments of $1,000. This reduces the cash ‘hit’ at year end, just when you might have to pay some corporate or personal taxes.

NOTE: You need to tell us about GST installment payments so these amounts can be recorded in the books and deducted in your netfiling. This will reduce the amount of GST to be remitted, or create/increase a refund.

Gotcha!

If your sales amounts are quite high (e.g. a renovator’s kitchen reno is $50,000) and you do not collect all the GST due right away, then you might wish to be careful about your invoicing.

Here’s why: The GST is ‘collected or collectible.’ In the above example, you’d be tempted to issue an invoice in the amount of $52,500.00 ($50,000 sale + $2,500 GST). Let’s say you decide to accept from your customer 5 monthly payments.

Here’s the thing: When the invoice is issued that $2,500 in GST is not collected. But it is collectible. Thus, this whole amount must be included in the next GST netfiling, and then sent to the CRA. Even though you haven’t received it from your customer!

If your company has the cash flow, then no problem. But, if you’d rather wait until your customer pays you, then you’ve got three solutions available:

- If the end of the reporting period is soon, delay issuing the invoice. Your company will collect the GST before having to pay it.

- Have your customer pay the $2,500 GST up front with their first installment. And so, in this example, the amounts paid would be $12,500, and then 4 payments of $10,000. (Be sure this is a clause in your contract!)

- Issue 5 invoices of $10,500 each ($10,000 + $500 GST).

Summary

In the first few years of the GST the CRA/Government of Canada was subjected to many, many false GST claims for refunds. As a result, they watch GST filings and remittances like a hawk. So, let us do it right for your company to avoid unnecessary CRA entanglements!