Hiring Your First Employee? Watch Out!

Make sure you take all the necessary steps to do this correctly! The LAST thing you want is labour standards entanglements. Here’s what you must think about ahead of this big step for your business.

Get Payroll Set Up

- Contact the Canada Revenue Agency (CRA) by phone to have them set up your business’s payroll account

- If your business’s CRA 9-digit business number (BN) is 123456789, then your business’s CRA payroll account number will likely be 123456789 RP0001 (sometimes the last digit varies)

- (FYI: Similarly, your CRA GST account number be something like 123456789 RT0001)

- Choose your pay period length (e.g. weekly, biweekly, semi-monthly, monthly)

- Often there’s a ‘normal’ length in your industry; you can use it or alter it

- This does NOT have to be the same for all your employees (e.g. hourly paid biweekly while salaried paid semi-monthly), but don’t make it too complicated!

- Choose your ‘cut-off’ period after the pay period’s last day until payday

- This is typically 5 to 7 calendar days/5 workdays

- This gives you time to prepare the hours for your payroll processor and time for pay cheques to be prepared

- Choose your payroll processing software and processor

- This might be your bookkeeping software or payroll processor’s (e.g. Payworks, Ceridian) system

- Use of the CRA’s Payroll Deductions Online Calculator (PDOC) is discouraged; most users don’t know how to correctly fill it in to get the right deduction calculations as the year goes on

- You might put the information into the software, or your bookkeeper or other person does it

- You must produce a ‘pay stub’ or ‘pay statement,’ and provide it to the employee every payday

- This might be your bookkeeping software or payroll processor’s (e.g. Payworks, Ceridian) system

- Choose how to pay Vacation Pay to your employees

- Most new employees will get 4% Vacation Pay, representing 2 weeks vacation

- 4% is typical; employers can pay more; some industries do this uniquely (e.g. construction)

- We recommend you pay out each payday (to avoid you having to monitor how much accrues and what’s been paid out); this is a company-level, human resources decision

- NOTE: Salaried employees typically do not get vacation pay; they are paid normally when they’re on vacation (unlike hourly-paid employees); again, this is a company-level, human resources decision

- Most new employees will get 4% Vacation Pay, representing 2 weeks vacation

- Choose what to include in your employees’ paycheques

- Earnings: Might be salaried (fixed amount per month); hourly rate; piecework; bonuses; vacation pay, government top-ups

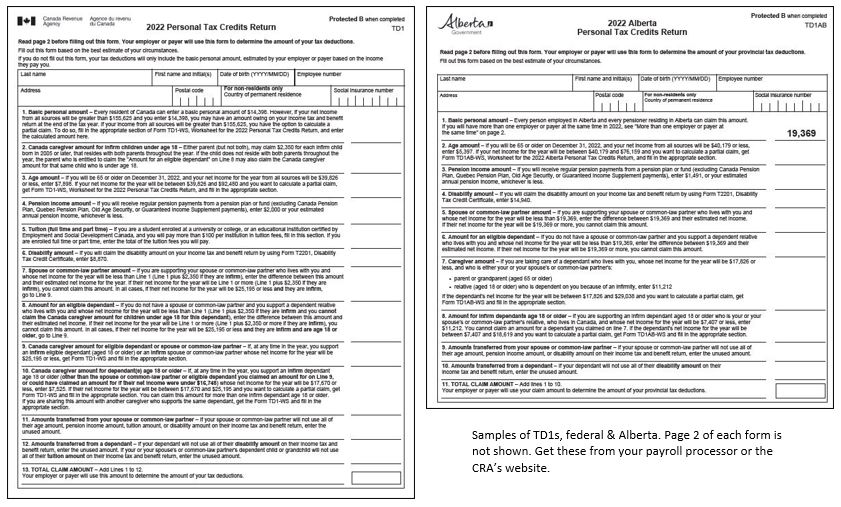

- Deductions: Statutory (tax, EI, CPP) based on the employee’s federal & provincial TD1 Personal Exemption Amount forms

- Other: Government top-ups; benefit premium deductions; expenses reimbursement

- Taxable benefits: Some ‘perks’ to employees are treated as taxable income and must be included (e.g. provided car)

- Choose how to deliver money to your employees

- Pay by cheque, etransfer, or direct deposit

- Use a commercial payroll processor to do direct deposits

- Choose how to notify employees on payday

- Employers must tell employees, each payday, how much s/he has earned and what deductions were made

- This is typically called a ‘pay stub’ (our preferred term) or ‘pay statement’

- It is typically emailed to the employee, or made available for download

What To Do When You Hire

- “Hire slowly and fire quickly” – Old human resources adage, well worth regarding

- Have an employment “Agreement” or “Contract” be signed by each employee before his or her first day

- This doesn’t have to be too complicated, especially for hourly employees; but it should outline how they get paid, the conditions, duties, and expectations of their employment with you

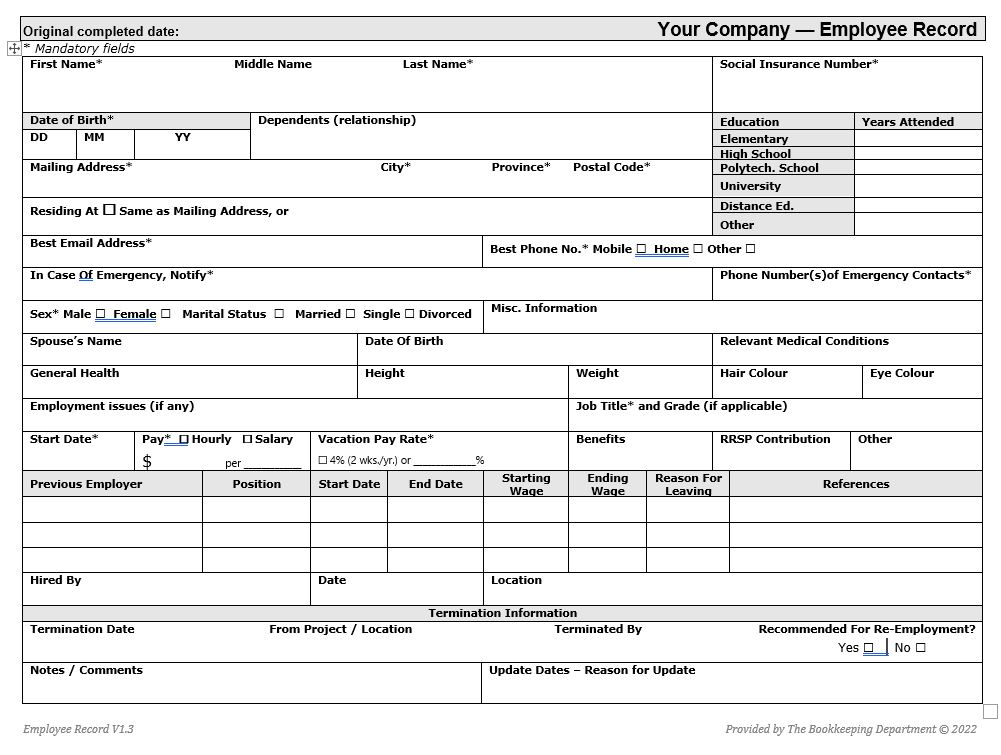

- Your and/or your employee should complete an “Employment Record” form of some sort; it captures key demographic and employment information your business must have. Here’s an example:

- Your employee must complete the federal and provincial TD1 Personal Tax Credits Return forms

- MUST be completed and sent to your payroll processor before the first payday

- If things change then employee can fill it out and re-submit it during the year (e.g. address changes; went back to school; got a second job)

- These, along with the completed Employee Record, do NOT have to be sent to the CRA; they MUST be available for inspection should the CRA ever ask for them

- Put these into a physical and/or digital employee Human Resources folder for safekeeping; update annually in early January to see if the employee’s circumstance have changed

What You Will Do Before Every Payday

- Gather employee information that determines earnings (e.g. hours worked, number of units built)

- Provide this immediately after the pay period ends

- Your payroll processor will calculate pay amounts and prepare a pay stub for each employee

- The pay stub can be emailed or, when a commercial service is engaged, the pay stub is made available online for download

- Pay employee using the method you’ve decided

What You Will Do Each Month

- Remit amounts to the CRA; this will include two parts:

- Employee statutory deductions: tax, EI & CPP premium amounts takes from the employee

- Employer amounts: You must contribute CPP (equal to employee amount) and EI (1.4 times the employee amount)

- The ‘PD7A’ report will tell you how much to remit monthly to the CRA

- Remit to the CRA sometime during the first 15 days of the month following

- For example, the remittances for January’s payroll (i.e. for ALL paydays during that month) must be received by the CRA between February 1st & 15th (pay online by the 14th)

- The PD7A is created by bookkeeping software like QuickBooks and is provided by your payroll processing person, e.g. your bookkeeper

- It’s NOT needed when hiring a commercial payroll processor; they automatically remit for you

- Remit to the CRA sometime during the first 15 days of the month following

- You pay the CRA either by:

- Cheque: Mail it along with a completed paper voucher provided by the CRA

- Online though your bank: Most banks and credit unions enable online payment of business taxes (e.g. corporate, GST, and payroll)

- NOTE: To pay online you need to know the gross total ‘wages’ (ALL earnings by all employees) for the month, the number of employees paid, and the amount to be remitted; this is what’s on the PD7A

- Via your commercial payroll processor: Your business gives them the money, and they send it along to the CRA

What You Will Do Each Year

- T4 Slips must be provided to all employees by Feb. 28th of the following calendar year

- They may be either snail-mailed (paper) to, or downloaded by, employees

- NOTE: They may NOT be emailed to employees, per CRA rule (considered insecure)

- You must report to the CRA the total earnings, deductions, # of employees, and remitted amounts made through the year

- This is done by completing a T4 Summary Form

- The T4 Summary is sent to the CRA with copies off all employees’ T4 slips

- Done by your commercial payroll processor, if you use one

- If you haven’t remitted enough to the CRA, then pay up!

- In early January, have employees complete the new year’s federal and provincial TD1 forms, and send them to your payroll processor to reflect any new circumstances in the new year’s pay cheques

Whew! That’s a lot, isn’t it?

That’s why we recommend that you hire us.

The Bookkeeping Department can take care of your payroll, whether you have 1 or 100+ employees!